Veteran Friendly Real Estate Agents We are VA Savvy

Table of Content

As such, the property must include a living area with suitable space for a kitchen, bathroom and bed. To help you gain more confidence in your ability to help our soldiers, we’ve gathered information on everything you should know about working with VA-loan clients. Are you interested in learning more about how you can help someone who has bravely served our country?

First, working with a licensed real estate professional can save home buyers time and money. Veterans may find that some real estate professionals who work near military towns may specialize in active duty relocations. Someone who is very familiar with the housing market will likely be able to help negotiate the best purchase price for the buyer’s budget.

Select Service

Poor time management is often an indicator of other shortcomings. Don’t put up with an agent who doesn’t respect you or your schedule. If you feel like your agent is doing you a “favor” by helping you find a home, you probably need a new one. No matter how much you’re spending on a home or how long it takes to find one, you should feel valued and respected. Found us the ideal realtor that not only showed us houses in our designated area and price range, but also one who went above and beyond with a great personality and communication skills. We were comfortable quickly purchasing a home from a different state and managed to do a door-to-door military move thanks to their vetted realtor.

An agent who has more experience working with VA borrowers may understand the VA loan process better. While agents may recommend a favorite lender, it’s ultimately the borrower’s responsibility to choose a lender that is experienced in VA loans. If the client’s eligibility in the program does not change and their mortgage loan does not close, they will receive $1,000. This offer does not apply to new purchase loans submitted to Rocket Mortgage through a mortgage broker. Rocket Mortgage reserves the right to cancel this offer at any time.

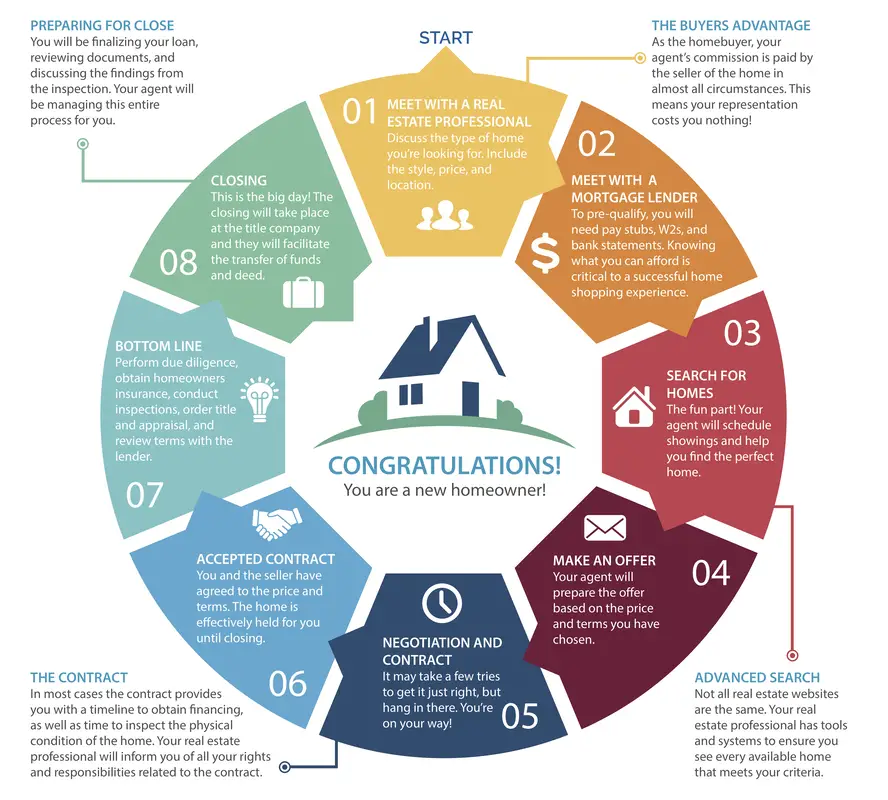

The Home Buying Process For Veterans

Because closing dates can and very often do get changed, and sometimes at the last minute. It’s a bad idea to hire movers and plan on moving into your new home on the same day you are required to close the deal. You could wind up having to reschedule the entire move-in based on circumstances far beyond your control.

Decide how much you want to spend on a mortgage—and be sure to include closing costs in the overall price. You’ll go through a private lender, like a bank or mortgage company, to get this loan. We’ll guarantee part of the loan against loss, which will allow your lender to give you better loan terms, like the option to pay no down payment. Your length of service or service commitment, duty status and character of service determine your eligibility for specific home loan benefits. Rachel Burris is a writer covering topics of interest to present and future homeowners, as well as industry insiders.

Can I Work With a 100% Military Disability Rating?

Veterans who qualify for VA home loans are willing to accept the seller’s eligibility in exchange for the new buyer’s. Find out if you can get a VA-backed IRRRL to help reduce your monthly payments or make them more stable. Find out if you can get a VA-backed purchase loan and get better terms than with a private lender loan. If you’ve served for at least 90 continuous days , you meet the minimum active-duty service requirement. You may be able to get a COE if you didn’t receive a dishonorable discharge and you meet the minimum active-duty service requirement based on when you served.

Either the new homeowner or the original homeowner is responsible for paying the closing and funding fee. The buyer must meet the lender’s defined credit score requirement as part of the qualification requirements, which usually range between 580 and 660. In addition, the buyer must also have a debt-to-income ratio of less than 41%. Personal financial documents will be required so the lender can determine whether you can afford the loan and your creditworthiness.

We definitely recommend WeVett, especially to the military community. We conduct in-depth interviews with qualified candidates to confirm their fit for your specific real estate needs. Give me more benefit content and other military content to my inbox. If your VA loan assumption is approved, you must sign the final document, including the deed of trust and liability release. A VA loan transfer or sale can be done under “certain circumstances,” including assumptions related to VA loans.

“Sellers have a few old misconceptions about VA loans that they are burdensome, take longer to close, have more requirements, etc. but for lenders, VA loans are one of the easier loan types,” says Viola. Of course, it’s not always the items on the appraisal that create a problem. Sometimes it’s the estimated home value itself that may lead to second thoughts or financing hiccups. Again, your client will have options if the appraisal comes back lower than expected.

This is in contrast to no appraisal required from an all-cash buyer or a different type of appraisal produced for a conventional buyer. You can chose either our real estate services or our lending services or both services...it's up to you. Reduce your rate, shrink your payment, get an escrow refund and by-pass 2 payments. The Dreamweaver Home Purchase ProcessTM delivers a fully CUSTOM renovated home, often for zero down and zero closing costs.

We offer VA home loan programs to help you buy, build, or improve a home or refinance your current home loan—including a VA direct loan and 3 VA-backed loans. You can ask your real estate agent to provide the lender with valid sales data showing the property is worth more than its appraised price. The lender will ask the appraiser to reconsider based on this information. Ask your real estate agent for advice on other options for voiding the contract you may want to include, such as if the property fails a home inspection. Teaming up with a lender who really understands VA loans is critical for ensuring a smooth transaction for your clients,” says Kraft.

Comments

Post a Comment